Stock market is not the only market that has been completely detached from the economy.

The real estate market is disconnected from reality as well. Despite the record unemployment and recession, residential properties are enjoying recovery in July.

How could this be happening?

There are three major reasons for that.

- We live in the era of “everything bubble”

According to fancy macroeconomic textbooks from the last century, each market should move independently of each other. However, in the last decade one thing has been easy to predict. Whether the markets move up, down, sideways or in circles, they are likely to be moving together. Commodities behave like bonds, which behave like equities. So when the stock market almost fully recovered from the March crash, so did the real estate. Simply put, in the everything bubble all markets are highly correlated. This is particularly true in the case of the real estate market, sometimes called the mother of all bubbles.

- There is supply and demand imbalance

As it is with other markets, property markets are also made up of supply and demand. When more people desire something, the price goes up. When fewer people want that same thing, the price goes down.

Let me elaborate.

Demand for the real estate is surging because the dollar and euro-denominated mortgage rates are at historical lows. For instance, in the US, the low rates have led to a 33% increase in mortgage applications from this time last year. Also, according to the US Mortgage Banks Association, the average value of a home purchase mortgage applications hit a record high of $359,000 at the end of June.

The supply side gets even better…

The residential real estate market is seeing a record low of supply. Simply, there are very few homes for sale in the market. Going into this crisis, there was an undersupply of the new housing. This is the key distinction between this downturn and the last one 2008, which was driven by an oversupply of housing. For example, according to the National Association of Realtors in the US, the supply of homes for sale fell 19.7% annually to the lowest April inventory figure ever. Similar situation is happening in the eurozone. According to the French FPI data, there were 60,000 housing projects in early 2018, 45,000 in 2019 and in 2020 the FPI projects the sharpest decline ever.

Here’s the bottom line.

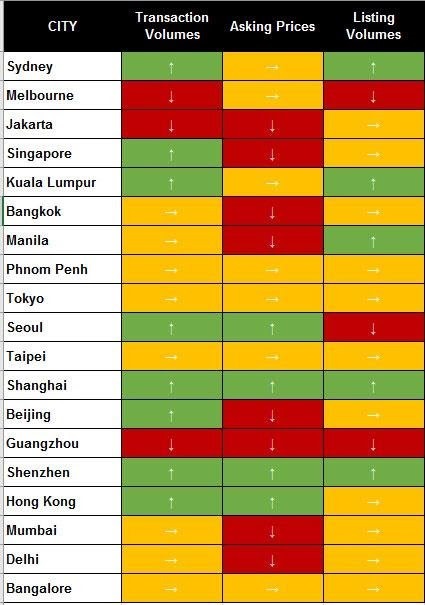

When you have accelerating demand and decreasing supply, prices have to increase in order to ensure that transactions get done. This scenario is well manifested in the latest Global Property Index research at Knight Frank. According to the research, sales volumes continue to recover and the average growth across 150 global cities was 4.3%.

There is simply too much competition for the few homes that are for sale.

Source: Knight Frank

- Investors are expecting high inflation

Money-printing usually results in inflation. And the prices of hard assets like properties traditionally benefit from high inflation. Trillions of government stimulus all over the world will eventually devalue major currencies. Also economies are flooded with new liquidity. According to FDIC data, a record $2 trillion surge in cash has hit the deposit accounts of U.S. banks since the coronavirus first struck. There is simply too much cash chasing few properties that are for sale.

The rise of real estate markets comes to me and many people as a surprise.

The question now is whether this can continue?

Short answer: All signs are pointing to a continued recovery. For Now.

I tend to believe that the reality of the economic shock will eventually win out over the artificial manipulation of an economy. Nobody knows for sure though.

Having said that, the markets have been so deeply manipulated by the actions of central banks that they are essentially broken.

According to Bridgewater’s Ray Dalio, founder of the world’s largest hedge fund, financial markets are no longer free.

“Today the economy and the markets are driven by the central banks and the coordination with the central government,” said Dalio.

Welcome to the wild, distorted and manipulated world of macroeconomics.