Our rulers have always understood one law. If you control the money, you control the world.

For millennia, the money was controlled by royalty and kings. Eventually, the merchants outsmarted the kings and established the central banks to create and manipulate the money supply without the consent of the kings.

The bankers knew that once they control the money supply, they will rule the world. Mayer Amschel Rothschild, the founder of the Rothschild dynasty, said it out loud,

“Permit me to issue and control the money of a nation, and I care not who makes its laws.”

The central banks now have the ability to create and manipulate the money supply as they see fit. And with COVID-19 as an excuse, they did what they did best. They brought the interest rates to 0% and pumped trillions of dollars into the economy.

As a result, the U.S. central bank’s balance sheet has nearly doubled since March 2020 and exceeded $8 trillion for the first time. It’s important to realize that before the financial crisis of 2008, the Federal Reserve balance sheet stood at less than $1 trillion.

In Europe, it’s no different. As a matter of fact, over the past year, Christine Lagarde’s European Central Bank has increased the size of its balance sheet from less than $5 trillion before the pandemic to its current level of around $9.5 trillion.

Click here for FEDERAL RESERVE statistical release

The way things are looking, there are four main messages that the latest action by the interventionist bring to the forefront.

Rich get richer while poor get poorer

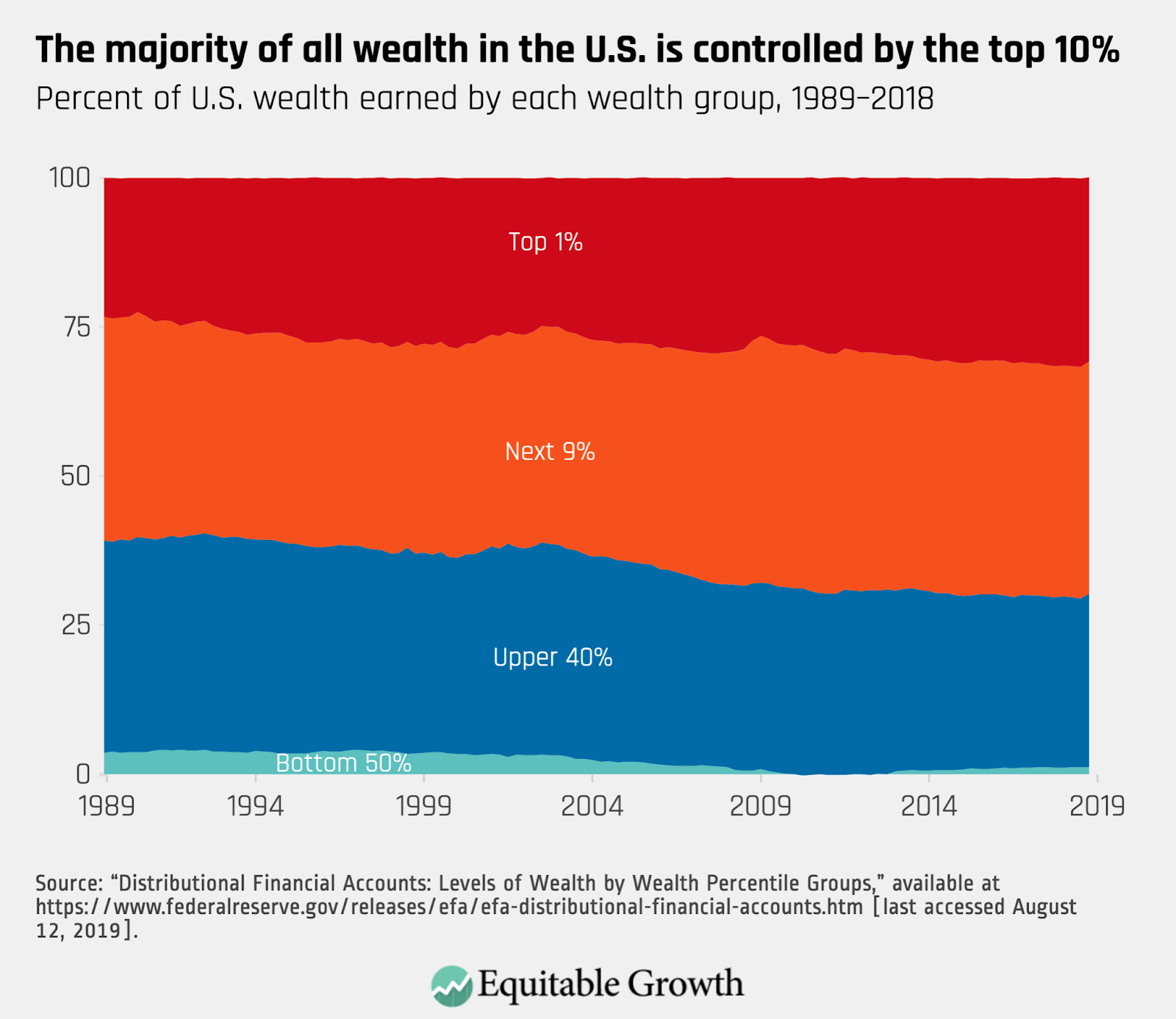

Inequality has been soaring, and gaps in income between the poorest and the wealthiest families have continued to widen. As wealth continues to concentrate at the top, now the richest 10% of American households control nearly 75% of household net worth.

This past week, we saw the S&P 500 hit an all-time high on the very same day that the Federal Reserve’s balance sheet hit an all-time high of over $8 trillion.

On top of that, small business owners can’t find enough labor to run their businesses because most people make more money from government support than they would in the labor market. There are more open jobs in the US economy than ever before, including pre-pandemic. People literally refuse to go back to work.

Through the actions of the central bankers, the economy has been tilted to benefit the asset owners. So the more assets you own, the more you see your wealth rise to the moon. And if you don’t own any assets, you can notice only the decline of your purchasing power.

The everything bubble

It would seem that the central bankers have learned little from the 2008 bursting of the U.S. housing and credit market bubble.

And thanks to Fed’s ultra-loose policies, we’re experiencing an “everything bubble” that is more pervasive than the previous bubble by a factor of ten.

The central banks’ zero interest policies and the unprecedented bond-buying activity have created the 30-year bond market bubble with $20 trillion in negative-yielding bonds. Likewise, the ultra-easy monetary policies inflated the stock market bubble, where at first sight of weakness, central banks come to the rescue.

In the same fashion, the real estate markets are at an all-time high, and some commodity prices have skyrocketed over 200% since the March 2020 lows.

Yet, investors are happily buying more at these levels fueled by the interest rates will remain at zero forever, and money printing will never stop. Not to mention, the younger investors are starting to believe there is no risk in the markets.

High inflation

Unless you’ve been living under a rock for the past decade, then chances are you have experienced inflation. According to alternative measures, inflation was in the range of 10-15% annually.

Even the highly distorted U.S. government measure of inflation hit 5% in May. Yet, economists and the mainstream media told us that inflation wouldn’t be a problem for most of last year.

Now that inflation is here, they tell us it is only transitory. In reality, there is no such thing as transitory inflation. Once businesses raise the prices, they never decrease them again. Besides, it’s not the prices that go up, and it’s our currencies that get devalued. If you pump trillions of dollars into the economy, you simply can’t expect any different outcome. To put it another way, the prices of goods and services are merely keeping pace with devaluation.

Central planned economies

Central banks have created centrally planned economies all over again. As a citizen of former Czechoslovakia, I remember this socialist madness vividly. It didn’t work then, and it will not work now or ever. As Einstein wrote, “insanity is doing the same thing over and over and expecting a different result.

Our children will pay a harsh price for this mad experiment.

Unfortunately, there is no turning back. The market has been manipulated to the point of no return. It’s unthinkable the politicians and central banks would stop intervening and let the free market do its job.

Despite the record-high money printing, the central bankers are met with applause and admiration by politicians and bankers. They claimed that people would die or end up in the street. This was a type of nonsense they been spreading on the television. The fact is that all they are trying is to save themselves.

And the point ofter overlooked is that we’re still all waiting to hear what one man or one woman from a central bank has to say in a press conference. That is a very definition of the centrally planned economy and the blind belief in authority.

What’s the solution?

People are waking up. They started to push back on the centralization, and they’re seeking a new system because their lives depend on it. The new system is not perfect, but people realized they don’t need central planning. The technology will disrupt the status quo.

But, it won’t happen overnight, but we are well on our way.

In the meantime, So don’t be gullible.

Get out of cash, sell your bonds and buy hard assets like the S&P 500 index, precious metals, or Bitcoin. It’s up to you.

The central bankers will continue to devalue the currencies and, in effect, drastically enrich anyone holding assets. You are going to look like investing genius. It’s just a matter of time.

You worked hard for your money. Don’t let it wither away at the hands of the rich and powerful.