Large banks like Credit Suisse are faltering and requiring bailouts, which leads to the question: Is your money really safe in traditional banking systems during a banking crisis? With Bitcoin and other cryptocurrencies gaining popularity, it is time to consider the role of these digital assets as potential safe havens.

But what are the possibilities and risks of storing wealth in Bitcoin during banking crises?

The Shaky Ground of Traditional Banks

The global financial ecosystem is in a precarious state. The collapse of Credit Suisse, a global-systemically important bank (G-SIB), has set off alarm bells worldwide.

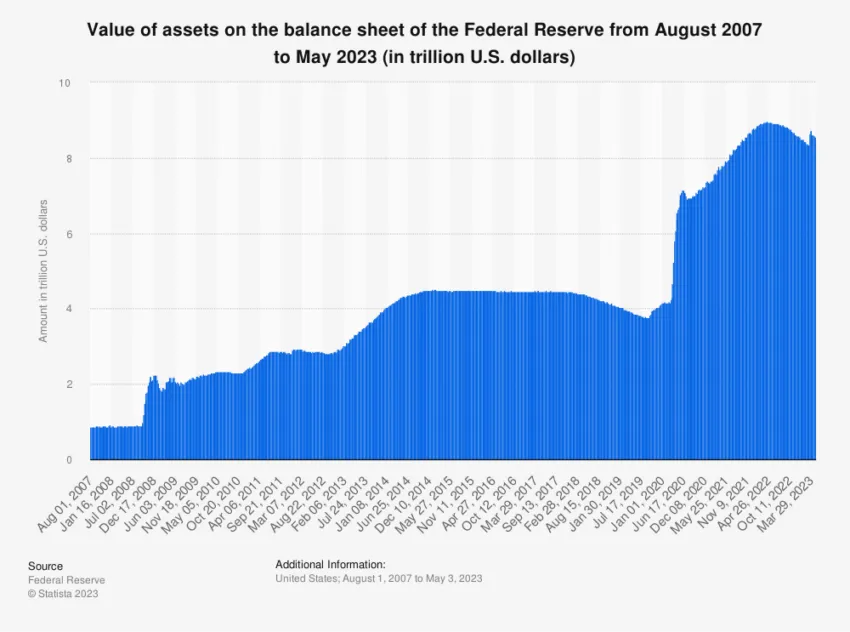

This failure, coupled with the fact that no banks fell during the last decade of quantitative easing (QE), prompts one to question the stability of our banking systems.

Historically, bank failures were a natural part of free markets, helping to purge excess risk. However, with governments and central banks expanding the money supply unprecedentedly, bank failures have become a rarity.

Is this a result of safer banking practices or merely a byproduct of money printing and government bailouts that have shifted the risk off bank balance sheets?

Countries like Canada have followed the G20 consensus, engaging in QE and issuing debt to finance deficit spending. Such practice has led to a surge in public and private debt-to-GDP ratios.